Annual Report and Accounts for the year ended 31 December 2022

Testing

Testing

Testing

Testing

Testing

Testing

Testing

Clear Focus

Right Approach

Delivery

Adopt emerging working practices, investing and collaborating to deliver our operational targets

Growth

Grow PBT by increasing capital employed to £500m by investing in our three key markets

People

Open, progressive, high performing business governed by clear objectives which engage diverse range of talent

Safety and the Environment

We aim to be the safest place to work in our markets and be respectful to our environment

2022 Highlights

Financial

Operational

Financial

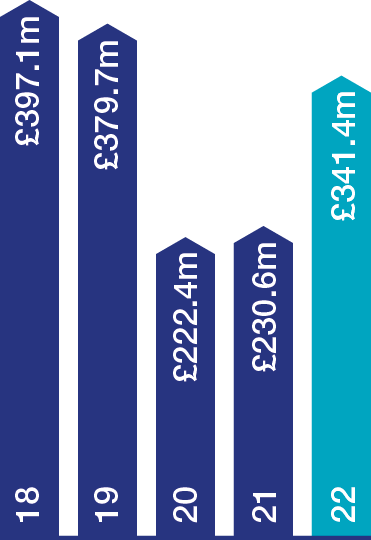

Group Revenue

£341.4m

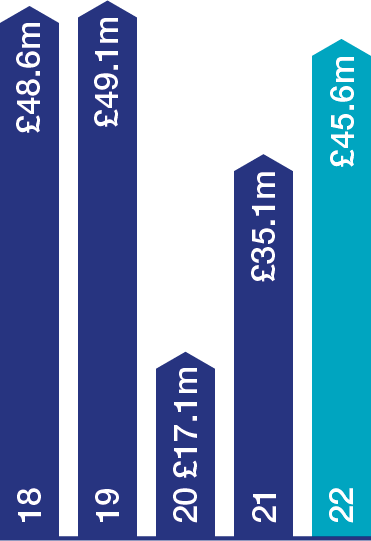

Profit Before Tax

£45.6m

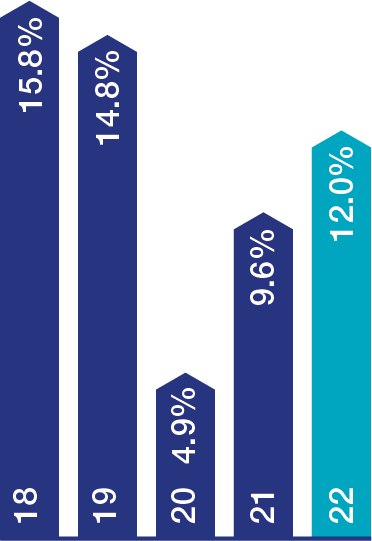

ROCE

12.0%

Earnings per Ordinary Share

25.0p

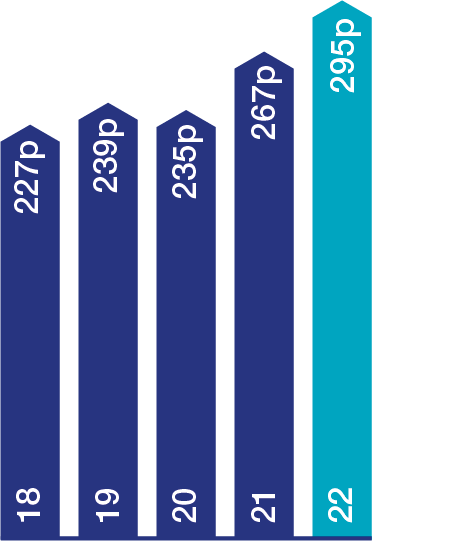

Net Asset Value per Ordinary Share

295p

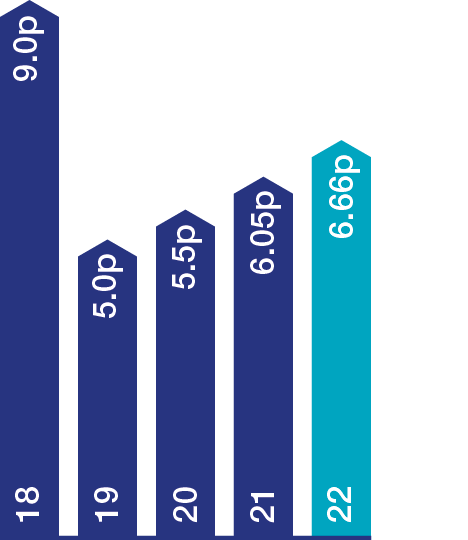

Dividend per Ordinary Share

6.66p

Operational

- £279m of sales led by our land promotion, property development and housebuilding businesses making the most of strong markets in the first half of the year

- Selective approach to acquisitions throughout the year, totalling £28.4m, including £27m of strategic investment to grow Hallam Land Management and Stonebridge Homes' land holdings

- Continued investment in our £240m high-quality committed development programme where costs are 97% fixed

- Land Promotion

- A record of 3,869 plots sold (2021: 3,008), driven by a major disposal at Didcot of 2,170 plots

- 9,431 plots with planning permission (2021: 12,865), leaving Hallam Land Management well positioned against a backdrop of an increasingly constrained planning system

- Property Investment & Development

- Significant committed development programme of £240m, with 63% pre-sold or pre-let

- Over 1m sq ft of Industrial & Logistics development underway (HBD Share: £150m GDV)

- £1.5bn development pipeline (Henry Boot share £1.25bn), 65% of which is focused on supply-constrained Industrial & Logistics markets, where occupier demand remains robust

- Well timed sales within the investment portfolio of £29.6m, at an average 17% premium to the last reported book value, contributed to total return outperformance of -1.5% versus CBRE Index of -9.1%

- Stonebridge Homes completed 175 homes (124 private/51 social) (2021: 120), at an average selling price for private homes of £503k (2021: £509k). Total owned and controlled land bank is now 1,094 plots (2021: 1,157) with detailed or outline planning permission on 872 plots (2021: 912)

- Construction

- The construction business performed ahead of budget with turnover of £101.5m (52% from public sector) out of £128.6m segment total and has secured 68% of 2023 order book

- Banner Plant has seen record levels of trading activity after experiencing strong demand from its customers and Road Link (A69) has performed well as a result of increasing traffic volumes

- Responsible Business

- Continuing to make good progress against our Responsible Business Strategy targets and objectives, launched in January 2022

NOTES:

This report contains the following alternative performance measures (APM): Underlying profit. Return on Capital Employed. Net Asset Value (NAV) per share. Net (debt)/cash. Total Accounting Return.

Investment case

Five reasons to invest

Five reasons to invest

Our Strengths

Our diversified businesses

Henry Boot operates across the whole property value chain.

With our uniquely sustainable business model we have built a market-leading Group of Companies that source, develop and deliver across the whole property value-chain.

We manage the combined effort and expertise of six primary subsidiaries, investing in our future to create long-term value and robust returns for all our stakeholders and partners

Our capital structure

We reinvest the cash generated from our investment portfolio and construction business into profitable areas of the business.

Our financial structure allows us to invest in the more profitable areas of the business to ensure we can maximise value, whilst maintaining prudent gearing levels. HBD's property investment portfolio generates rental income each year, allowing us to borrow against the investment portfolio at attractive rates. The construction segment is self-funded and cash generative, resulting in the cash produced from these activities being invested into strategic land and property development.

Our planning and development expertise

The Group has been in business for over 135 years and we are valued for our expertise and forward-thinking approach.

Henry Boot recognises that our people are fundamental to the success and sustainability of the Group. It is their expertise that executes our business model successfully and delivers the value created by the business to our stakeholders.

Our relationships

We have close relationships with landowners', key property advisers to alert us to potential opportunities; and planning consultants and legal advisers for knowledge and guidance.

At Henry Boot we pride ourselves on collaboration. We set clear mutual expectations and strive to achieve them. We promote cross-team working, and work in partnership to make things happen.

Our performance

We have confidence in Achieving our medium-term Growth and return targets

Tim Roberts

Chief Executive Officer

Download the CEO'S Statement

Download the CEO'S StatementStrong sales significantly Increasing profitability

Darren Littlewood

Chief Financial Officer

Download the CFO's Statement

Download the CFO's StatementOur purpose

To empower and develop our people to create long-term value and sustainable growth for our stakeholders. Our stakeholders are our shareholders, employees, pensioners, customers and suppliers. More broadly, we recognise our duties to the environment and the communities we operate.

Empowering and developing our people sits at the core of our being. This focus shapes our values and behaviours and is also a key aspect of our strategic priorities. Being purpose-led enables us to create long-term value for our stakeholders and ultimately achieve our vision.